Products/Schemes

| Scheme | Period | Interest rate |

|---|---|---|

| NR | 0-3 months | 19% |

| 3-6 Months | 22% | |

| Above 6 Months | 24% C | |

| WINTER15 | 0-1 months | 15% |

| 1-3 Months | 18% | |

| 3-6 Months | 22% | |

| Above 6 Months | 24% C | |

| YEAREND12 | 0-1 month | 12% |

| 1-2 Months | 18% | |

| 2-3 Months | 21% | |

| Above 3 Months | 27% C | |

| POOJA23K | 0-2 months | 22% |

| Above 2 Months | 24% C | |

| *DPN 10% on Gold Loan | ||

| POOJA21 | 0-1 month | 22% |

| Above 2 Months | 24% C | |

| *DPN 10% on Gold Loan | ||

| EMI (11%) | Installments - 6, 12 & 24 months | |

GOLD LOAN -EQUATED MONTHLY INSTALLMENT SCHEME (EMI) @11%

What is EMI?

Equated Monthly Installment-EMI' A fixed payment amount made by a borrower to a lender at a specified date each calendar month. Equated monthly installments are used to pay off both interest and principal each month, so that over a specified number of years, the loan is paid off in full.

What are the factors affecting an EMI?

The EMI of a loan depends on three factors :

1) Loan amount :

This stands for the total amount that has been borrowed the individual.

2)Interest rate

:

This stands for the rate at which the interest is charged on the amount borrowed.

3) Tenure of loan

This stands for the agreed loan repayment time-frame between the borrower and the lender.

Considering the above mentioned three governing factors, the EMI payments are directly proportional to loan amount and interest rates and are inversely proportional to the tenure of loan. The higher the loan amount or interest rate, the higher is the EMI payments and vice versa. In case of tenure of loan, though the amount of total interest to be paid increases with the increase in tenure, the EMI payments decrease with the increase in tenure.

Equated Monthly Installment (EMI) loan @11% p.a. interest is now available to the customers for repayment of their gold Loan liability which is payable in easy equal 3,6,9,12,24 monthly installments.

For an EMI loan of Rs.5000/-for a period of 12 months the installment amount payable every month is only Rs.473/-. If the term is 24 months the installment amount comes to only Rs.264/-. The monthly installment amount includes interest for the loan. The minimum amount of loan is Rs 5000/- and in multiples of Rs.500 /- thereafter. The monthly installments also can be remitted in advance in which cases a discount will be available for such remittances.

GOLD LOAN -PART PAYMENT FACILITY: - EAZY & FLEXIBLE REPAYMENTS

The facility of part payment in convenient installments is available for gold loan amount and its interest. If the payment of interest that is due up to the present date is remitted at any day, then the minimum interest rate of that particular scheme will be eligible for the loan from that date onwards. For loans which are more than one month old, a minimum of one month interest has to be collected. Whereas if the interest due is more than 8 months, then the customer should pay at least half of the interest

ONLINE GOLD LOAN

This is a new product launched by Muthoot Mercantile Limited. With online gold loan, customer can make repayment of their loan as a part payment or full settlement at any time from any place. On availing a loan for the first time and after settlement of the said liability, the customer can avail subsequent loans online provided he is depositing his gold ornaments with the company after full settlement of the first liability. In this case the loan amount is instantly credited to your savings bank account registered with us, whenever the customer request for a loan again in future. The loan is disbursed on the basis of the value of gold pledged at the branch. The part payment and full settlement made online will be effective on the same day to the customer’s loan account. The customer can avail this facility by using their email and password.

As we are living in the digital world and to protect us from the epidemic, most people prefer the 'Online' medium is the most convenient mode to do business and other transactions. Muthoot (MML), India's most trusted gold loan company make available its online financial services through Online Gold Loan

With this new scheme 'MuthootOnline Gold Loan’ Customers can avail new loan without any visit to our branches, TOPUP your existing loan amount (Topup) and renew eligible loans, making payment of interest and principal re-payments on their gold loans using Debit Card / Credit Card/ Google Pay/ Paytm and Net Banking. To facilitate this service, we have partnered with leading Banks and online payment gateway service providers.

We provide online gold loans at the lowest interest rates in the market. We also aim at pleasant customer experience for our borrowers. Without any processing fee and appraiser charges, lower interest rates , personalized support, on-demand doorstep pickup and disbursal of your valuables at your door steps and we care for your every need with our unique services.We’re a technology company built on the belief that innovative and creative financial solutions deliver more value.

Whether you are a 'new-to-credit' customer or lack the necessary documentation to get approved for a loan from other banks, you can be assured that you can still be eligible for a loan against gold from Muthoot Mercantile Ltd.

We ensure that your gold and ornaments are stored in our Strong Room Wallet with 110% insurance coverage 256-bit encryption, industry best practices in security, and multiple threat mitigation techniques or we secure at bank vault with our banking partners, each a trusted and reputed bank, known across the country. We perform security audits and have a custom security strategy so that your data is kept safe from prying eyes.

Key Features:-

- Cash at Home

- Free Of Cost

- Quick Processing

- No Processing Charges

- No Appraiser charges

- Instant Money To Your Account

- Free Insurance Coverage

- No need of CIBIL score

- No need of salary slips or land tax receipts

MUTHOOT MERCANTILE ONLINE GOLD LOAN (MMOGL)

FAQS – FREQUENTLY ASKED QUESTIONS

- Introduction to Muthoot Mercantile Online Gold Loan (MMOGL)

MUTHOOT MERCANTILE OLINE GOLD LOAN (MMOGL) is a customer friendly online Gold Loan facility, by which a customer can make his interest and loan payment any time from any place through Muthoot Online Gold Loan Portal.

2) How can one access the MMOGL Portal?

He / She should be a Muthoot Mercantile customer and can access the MMOGL Portal by entering their User ID and Password.

3) How to get User ID and Password by the customer?

Customer can use their e-mail id as their user ID. An OTP (One Time Password) will be generated at the time of online registration after pledging his gold ornaments in any of our branches.

4) How to change the password if one forgets?

The customer can change his password any time through the “Forget my password” option within the MMOGL Portal.

5) What are the services offered by Muthoot Mercantile Limited through its MMOGL Portal?

Customers can enjoy the following facilities by logging in into MMOGL

a) Make payments against Gold Loan account through Debit Card/Net Banking/UPI.

b) Download one-time MMOGL form

c) View the statement of account of the Gold Loan

6) What a new customer has to do for avail MMOGL?

A new customer has to visit their nearest Muthoot Mercantile branch to avail a normal (i.e., Offline mode) Gold Loan once and complete the formalities for one-time registration.

7) How to authenticate one-time registration?

A valid mobile number is essential for one-time registration. At the time of one-time registration, our Company system sends a One-Time Password to the mobile number furnished by the customer for authenticating one-time registration.

8) How can a customer change his Mobile number already provided to the branch?

A customer has to visit his home branch and intimate the change of Mobile number to the branch.

9) How can an existing customer access MMOGL?

Existing customers have to complete the formalities for accessing the MMOGL module (i.e., one-time registration) within the MMOGL Portal by visiting a branch.

10) How can a customer settle the Gold Loan through online?

Customer can settle the Gold Loan A/c by logging in into the MMOGL Portal by using their User ID and Password. After logging in, a secured web page will appear where he can select their account and make the payment by choosing Debit Card or Net Banking or UPI.

11) How can a customer authenticate Gold Loan transaction in MMOGL?

Customer can authenticate Gold Loan transactions under MMOGL by using OTP sent to the customer’s registered mobile number at the time of initiation of such transaction.

12) How to release gold ornaments from the branch?

Customer has to settle the loan account either online or at Branch. After the settlement, he has to produce the original pawn ticket at the branch. After the formalities he will get back his ornaments and he has to acknowledge the same.

We have introduced a new facility for the benefit of our existing customers in Muthoot Mercantile Limited. Customers can top-up their existing gold loans depending on the Gold Loan rate and LTV (Loan to value) ratio.

Branches have to complete the following steps for activation of online top up facility.

Existing customer has to visit the branch (one time process) for activating MML online top up facility. Branches on receipt of the request from the customer, have to go through the following process:-

(a) Open customer details pages in MuthootOne software.

(b) Click agree for top-up online loan check box in customer details page.

(c) A Message Pop will appear on the screen.

(d) Click ‘yes’ button for adding customer bank details.

(e) a) Enter all details in customer bank details page and save.

These 2 documents have to be uploaded into the software in their respective places. Branch Mangers, Branch-in-Chargers have to verify the application and sign as having verified. Scanned copy of the application form required to be forwarded to Head Office for further necessary action.

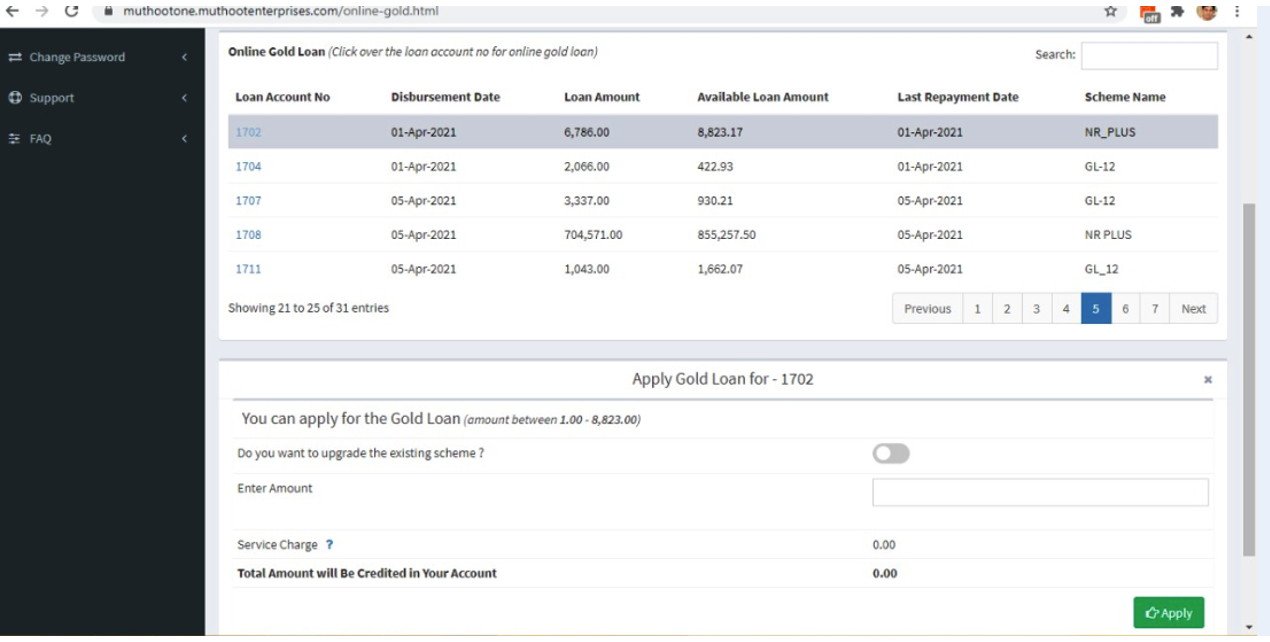

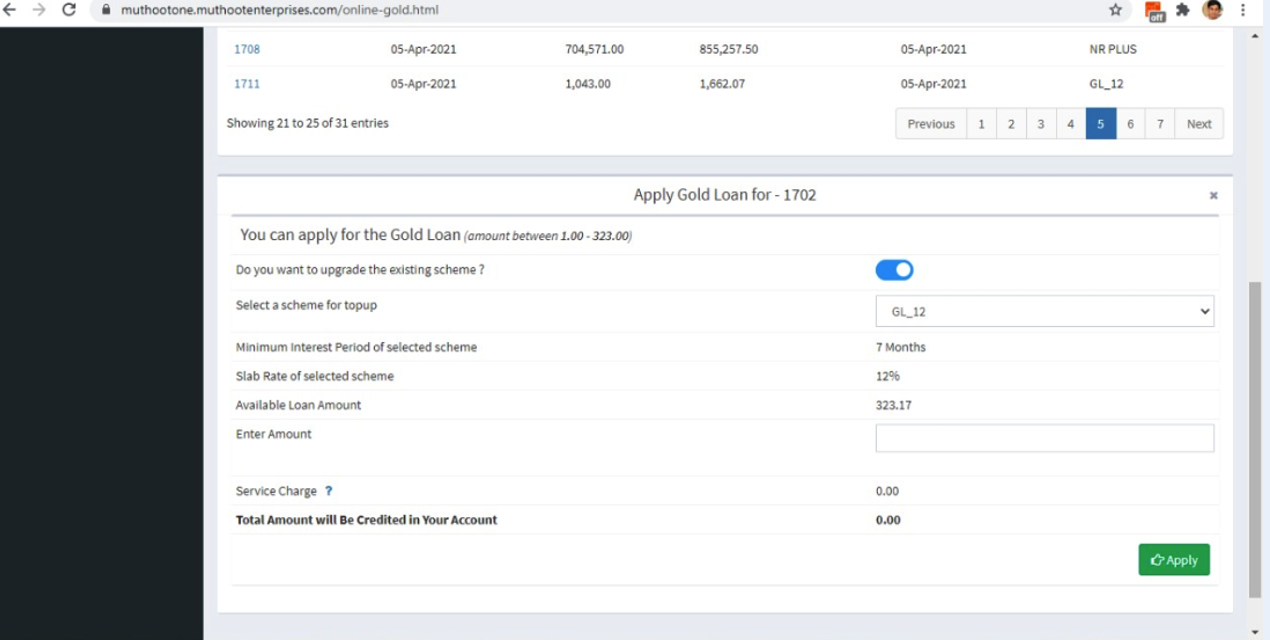

Step-by- step procedure for customers to avail online top-up :-

- Log on to www.muthootenterprises.com

- Give user Id and password

- Select online gold loan

You can see the maximum amount that can be topped up.

(In case the customer has not remitted the interest earlier, then the total loan amount will be including the interest due.

Gold Loan @ Home

With this new scheme 'Muthoot Gold Loan at Home'. Customers can avail new loan without any visit to our branches. Just dial us, we will process your gold loan after the initial call with you by our personnel, our loan manager will be scheduled to meet with you at your home. He will collect the KYC do gold appraisal, link your saving bank account with pledge and generate new pledge tickets for you. Your loan will disbursed as soon as this process is completed. Our loan manager will only leave with the gold once the amount is transferred to your account.

We provide the highest per gram rate, lowest interest rate and the longest tenor away all financial institutions. The schemes currently being offered can be viewed at our web site and Mobile app or can be gathered from our call center.

- No need to visit our branches to avail gold loan. Do your business or enjoy your life at home. We will meet you at your home and facilitate you to avail the loan.

- Avail a gold loan anytime, from anywhere. (Conditions apply *)

- No hidden charges, fully transparent

- Loans up to Rs. 10 crore

- Register for Online Gold Loan Service / Register or login using your mobile number registered with us / Download our Muthoot Digital app / Make a call at our Call Center

- Fill your details through our online application or mobile app or inform our call center and they will assist to complete the process

- Update KYC Details/ Upload attested scanned copy of your Aadhar/ Pan

- Link your Savings Bank Account

- Our loan managers shall visit you, appraise the gold and create a New Pledge with details and Photos of your gold, maximum eligible loan amount, loan availed etc

- The availed loan amount is transferred to your bank account immediately.The loan processing takes less than 30 minutes and the entire process takes less than 45 minutes to 1 hour

- Easy documentation, instant approval, convenient 24X7 online repayment

- Hassle-free, paper-less transaction from your mobile device

- Free safe custody for your valuable gold .100% safety and security for your gold or most valuable jewellery

- Pay interest only for the loan availed period exact number of days*

- View your active gold loans and outstanding interest and payment details, along with any additional eligible loan amount available to withdraw (Topup)

- Pay interest and principal re-payments against each or multiple loans in single transaction using Debit card / Net banking facility / UPI mode through highly secured payment gateway system.

- Withdraw additional eligible loan amount available against each loan directly to the registered bank account.

- Renew eligible loans through online itself.

- Topup your loan on the basis your eligibility

To meet the requirements of the gold loan, we are issuing non-convertible secured redeemable debentures as well as subordinated debts. The funds realized through debentures are fully utilized for the grant of loan against security of gold. The fund in no way is utilized otherwise. Hence the investments with us are 100% secured.

To know more about the non-convertible secured debenture’s you may contact us at it.muthootmm@gmail.comThe major services are

Western Union money service | X-press money | Transfast | Money gram | X-pay Domestic Money transfer purpose.

- • RBI approved remittance

- • No service charges to receive

- • Quick and hassle free money transfers

- • No requirement of bank account for receiving up to Rs. 50000/-

- • Money gram – 8 digits

- • Western Union -10 digits

- • X press money -16 digits

- • Transfast – 13 alpha numerical /12 digits ( for remittance from Saudi)

Domestic Money Transfer allows you to send money instantly 24 x 7 x 365 to any IMPS supported banks in India. Receiver will get the money credited into their bank account within 5 -10 seconds.

Domestic Money Transfer works exactly same as how Mobile Recharge works, only difference is that instead of mobile number you need to collect the beneficiary bank account number, IFSC Code and the amount which needs to be transferred.

Enter the details into a simple web form and complete the transaction. The beneficiary account will be credited the amount within 5-10 seconds.

Our platform supports IMPS & NEFT transfer modes and the system automatically switches the transfer mode.

IMPS: Immediate Payment Service is an inter bank electronic instant money transfer service which allows sending and receiving money 24 x 7 x 365. The platform is powered by the National Payment Corporation of India (NPCI) who settles the IMPS transactions in India on real time basis 24 x 7 x 365

NEFT : National Electronic Fund Transfer under RBI which settles NEFT transactions in India as batch wise.

Our health insurance plans are designed to cater to diverse medical needs of public, to ensure that they have access to the best quality healthcare when they need it the most.

We partner with reputable health insurance companies, ensuring that our customers receive top-notch care from trusted professionals. With the various health insurance plans provided by top companies in this field, we give them access to a vast network of hospitals and healthcare providers.